A leaking roof, cracked foundation, or outdated electrical system can shake any homeowner’s sense of stability. Big repairs rarely arrive with much warning and figuring out how to pay for them can feel like solving a financial puzzle.

Fortunately, there are several strategies that can help you prepare, prioritize, and finance essential fixes without sinking into unmanageable debt.

Quick Takeaways for Homeowners

● Set up a dedicated home-repair reserve fund before emergencies strike.

● Compare financing options before committing.

● Understand how large-scale refinancing can unlock equity for major projects.

● Always factor future maintenance into your long-term housing budget.

Assess and Prioritize What Needs Fixing

Before reaching for any loan application, inspect what’s truly urgent. Structural, safety, or weatherproofing issues come first; cosmetic upgrades can wait.

If multiple repairs compete for attention, consider hiring a licensed inspector or contractor to prepare an itemized estimate.

Once you know the scope, get at least three bids for any major job. Price comparisons often reveal wide differences in labor and material costs.

Smart Ways to Finance Major Repairs

When savings won’t stretch far enough, homeowners often turn to these solutions:

Popular Funding Avenues

● Emergency savings or repair fund: The least expensive route if money has already been set aside.

● Home equity loan or HELOC: Lets you borrow against built-up equity, usually with lower interest than credit cards.

● Personal loan: Fixed-term financing that’s fast to obtain but may carry higher rates.

● Credit cards with 0% intro APR: Useful only if you can pay off the balance before the promotional period ends.

● Government or utility programs: In certain regions, grants or low-interest loans exist for energy efficiency or accessibility improvements.

Each option carries trade-offs. Home equity borrowing ties debt to your property; personal loans safeguard the home but cost more in interest. The right choice depends on your credit profile, timeline, and comfort with risk.

How to Prepare Before the First Leak or Crack Appears

Preventive preparation saves enormous stress later. Here’s a quick checklist to help you build readiness into your household routine.

● Create a separate emergency savings account covering at least three months of housing costs.

● Schedule an annual roof, HVAC, and foundation inspection.

● Review homeowners insurance for coverage gaps (like flooding or sewer backup).

● Keep digital copies of major appliance receipts and warranties.

● Track all improvements; they may boost your home’s resale value and tax basis.

Consistent record-keeping not only simplifies future claims but also strengthens your position when applying for financing.

A Refinancing Option for High-Value Homes

Homeowners with luxury or high-appraised properties have another route for handling expensive renovations: the jumbo refinance.

This type of refinancing allows you to replace your existing mortgage with a new one that can unlock home equity or offer better terms. Because jumbo loans are designed for properties exceeding conventional lending limits, they’re well suited to borrowers with strong assets or improved financial standing since their original loan.

A jumbo refinance can consolidate repair expenses into a single monthly payment and may reduce total interest if rates have fallen. Like any major financial move, it requires careful evaluation of fees, appraisal value, and potential savings.

Comparing Your Options Side by Side

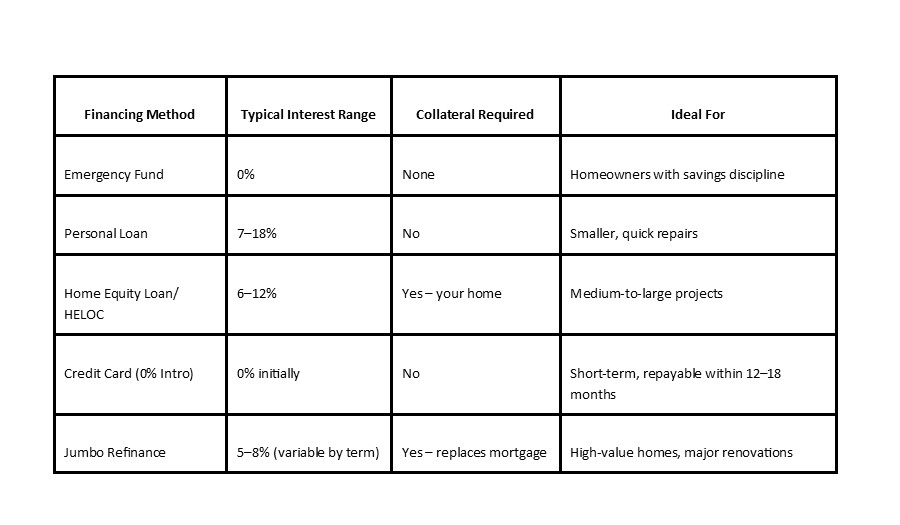

The right choice depends on your home’s equity, credit score, and the size of the project. The table below offers a snapshot.

Protecting Your Credit and Cash Flow

Borrowing can solve an urgent problem but create longer-term strain if mishandled. Always run a full household budget before signing. Ask yourself: Can I comfortably handle the payment if rates rise or income dips? Even small changes in interest rates can significantly alter monthly costs on large balances. To stay resilient, maintain an emergency cushion equal to at least three loan payments after any major borrowing. If possible, automate payments to avoid late fees or credit-score hits.

When to Bring in Professional Advice

Financial advisors or mortgage specialists can evaluate whether refinancing, equity loans, or blended approaches make sense for your tax situation. Contractors, too, can advise on phasing — spreading improvements over several months to match cash availability. The small cost of professional insight often prevents expensive missteps.

Answers for Homeowners Facing Big Repair Bills

Before you make a decision, here are some of the most common end-of-journey questions homeowners ask when repairs can’t wait.

“Can I negotiate repair costs?”

Yes. Always request a detailed estimate and ask contractors to separate labor from materials. Many will match competitor bids or offer discounts for off-season scheduling.

“Is it better to use home equity or refinance?”

If you have significant equity and rates are favorable, refinancing — including a jumbo refinance for high-value homes — may simplify payments. For smaller projects, a HELOC’s flexibility could make more sense.

“Will financing repairs increase my home’s value?”

Structural, roofing, plumbing, and energy-efficiency upgrades typically return the highest value. Cosmetic changes deliver less ROI but may still enhance livability.

“How long does it take to get approved for funding?”

Personal loans can fund within days. Refinancing or home-equity loans usually take several weeks due to appraisals and underwriting.

“What happens if I delay major repairs?”

Postponing critical fixes can lead to cascading damage and higher future costs — especially with water intrusion, foundation issues, or electrical hazards.

“Can I combine repairs with other financial goals?”

Absolutely. Many homeowners coordinate repairs with upgrades that cut ongoing expenses — like replacing an aging HVAC system with a high-efficiency model that lowers utility bills.

The Bottom Line

Covering major home repairs doesn’t have to jeopardize your financial future. Preparation, clear prioritization, and a thoughtful approach to borrowing can turn emergencies into manageable projects. Whether you draw from savings, explore equity-based lending, or pursue a jumbo refinance for large properties, the key is balance, keeping your home safe while protecting your long-term financial health.